Data-Management

The module takes care of data collection from the Client’s source systems relating to the Account Holders, their accounts and the related parties connected to the accounts automatically, periodically and in an intelligent way through configurations. Data Management module facilitates the user to process data for every month and also multiple times during the current month processing for data remediation purposes. This enables the RFI to examine the data for ensuring accuracy and completeness.

Schedule a DemoSegregate your compliance data by account, account holder, by entity and by related party entities in the application.

Data organization primarily loads the client and account master data & balances and transactions data of all customers of the reporting financial institution organizing them cleanly in the application for easy understanding of the user.

Learn More

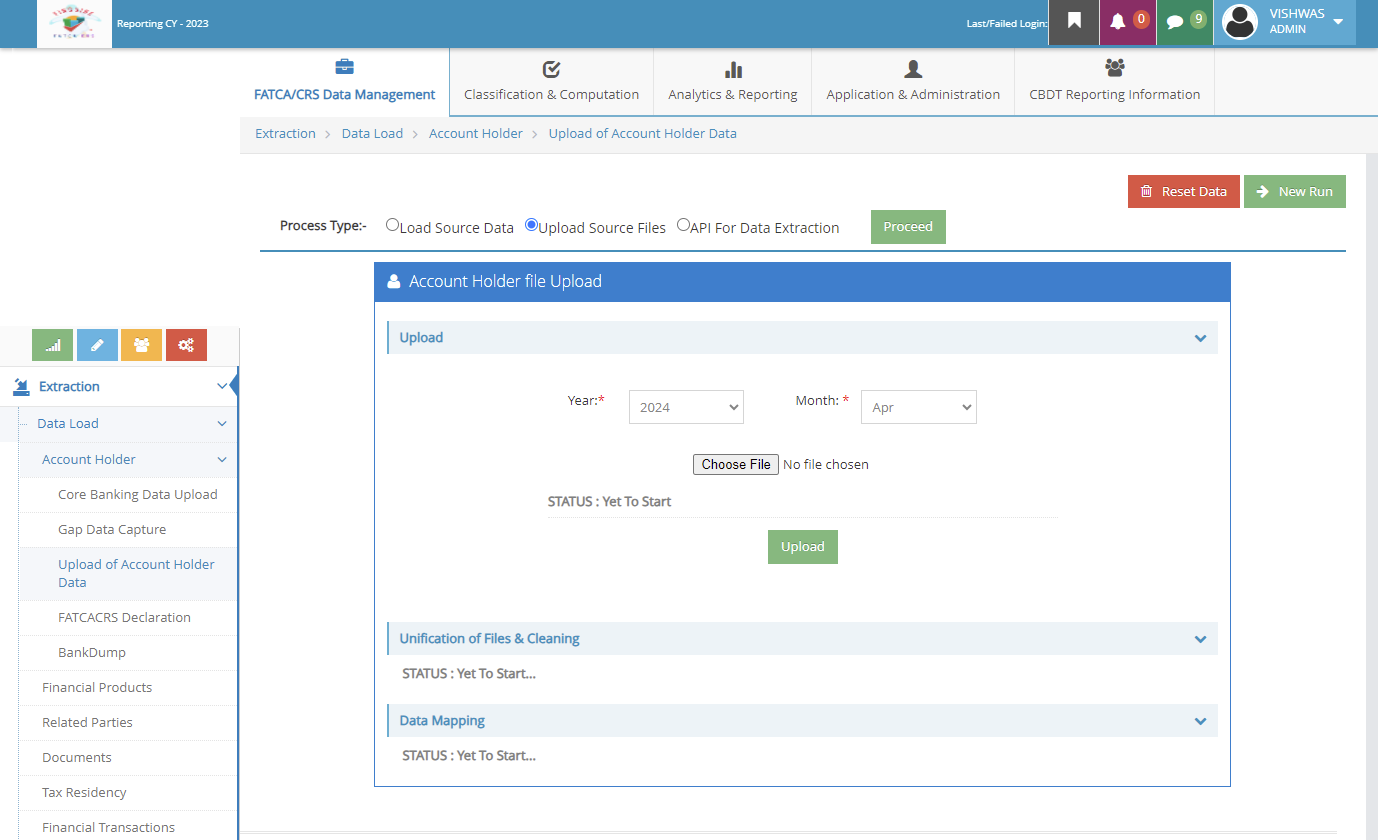

Can Extract data from any source system to any format manually or using API in a pre-configured periodic manner.

Finguine allows seamless integration with all In-house line of business systems to extract data using rules based on data reference points such as closing balance in an account details as on a recent date or on reporting date along with the currency details.

Learn More

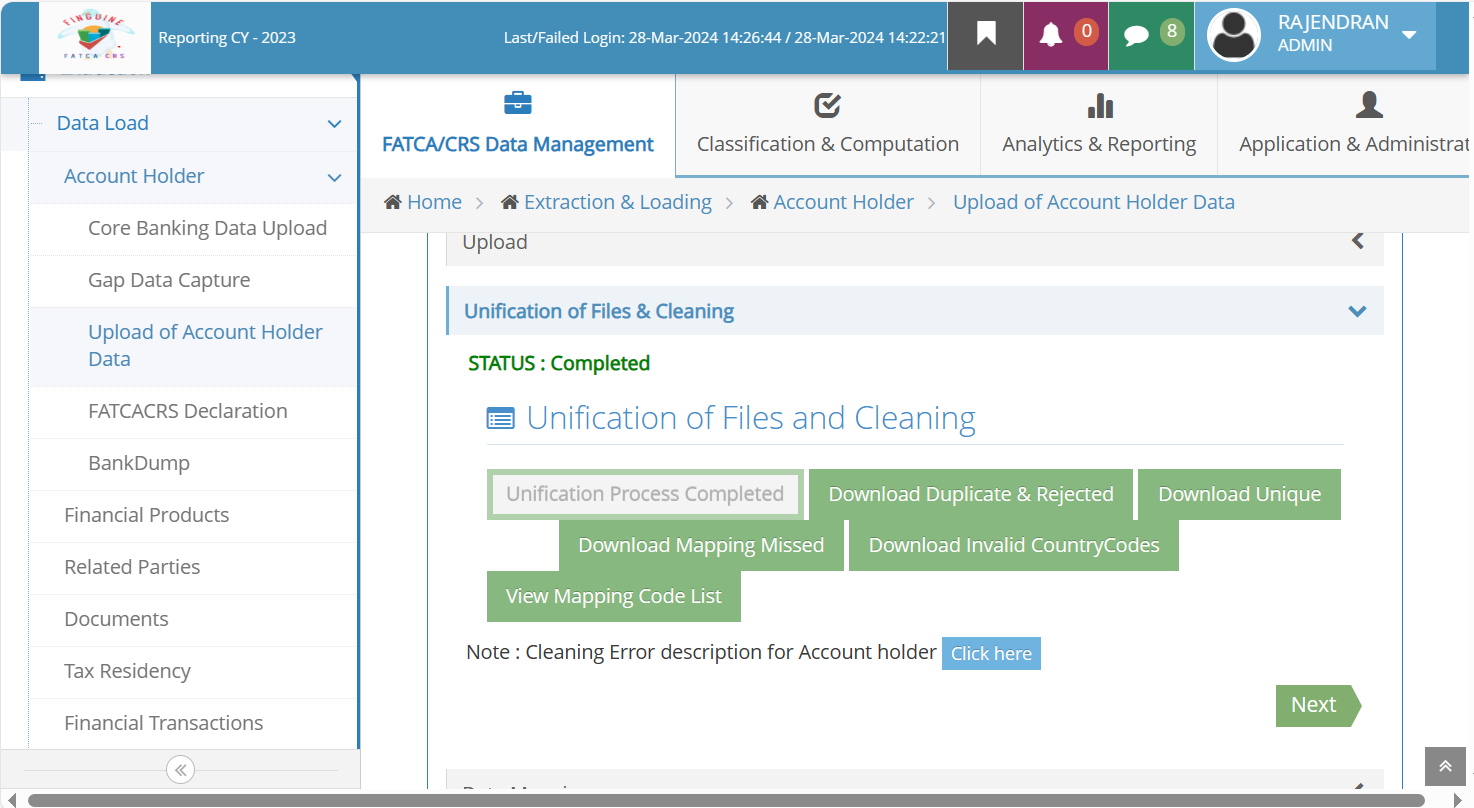

Normalizing, Standardizing and Unifying the data by combining various operational systems to single source by Deduplications for productivity and efficiency.

Enhances data quality and lowering the possibility of duplication are two benefits of consolidating process data. Data unification isn’t a one-time event. It’s a continuous process, because any periodic addition of new data or updation of existing data means dedicating a segment of their team to data unification only.

Learn More

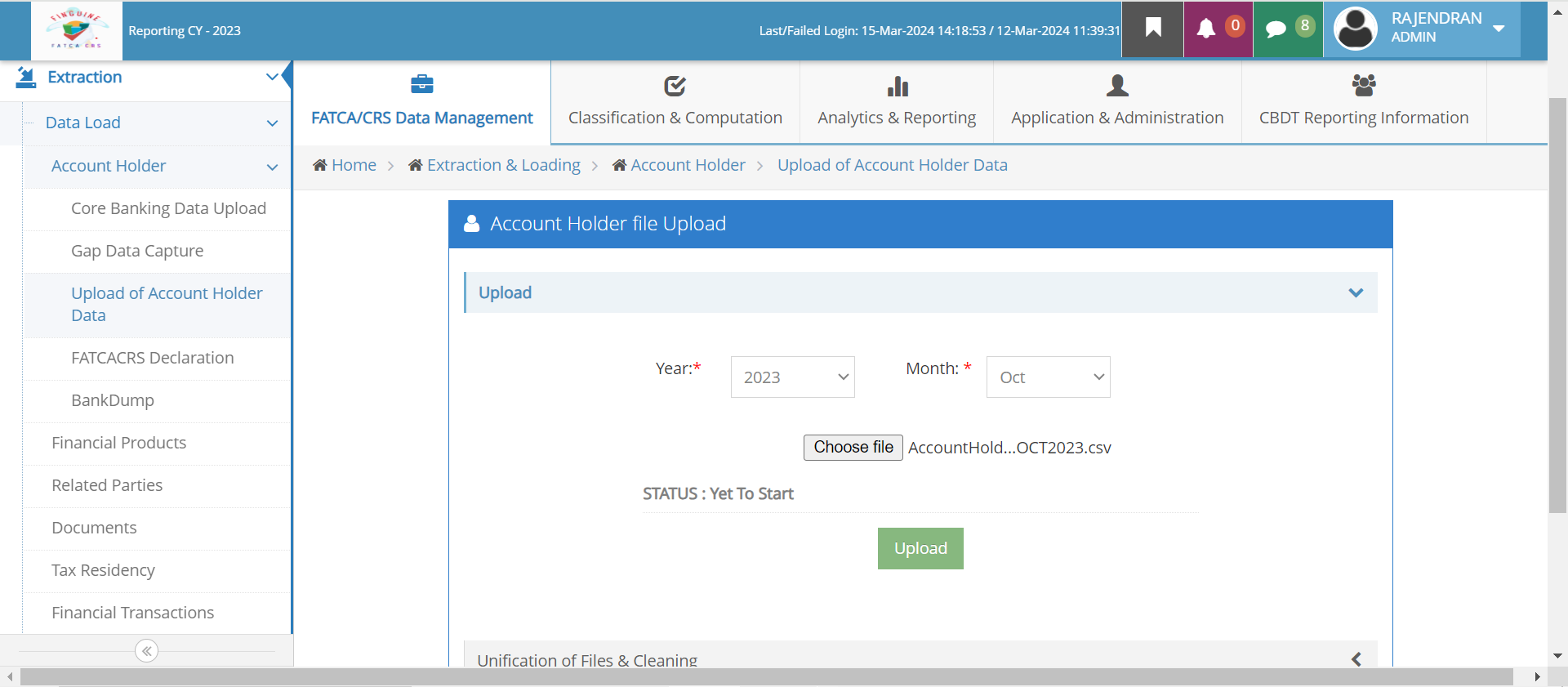

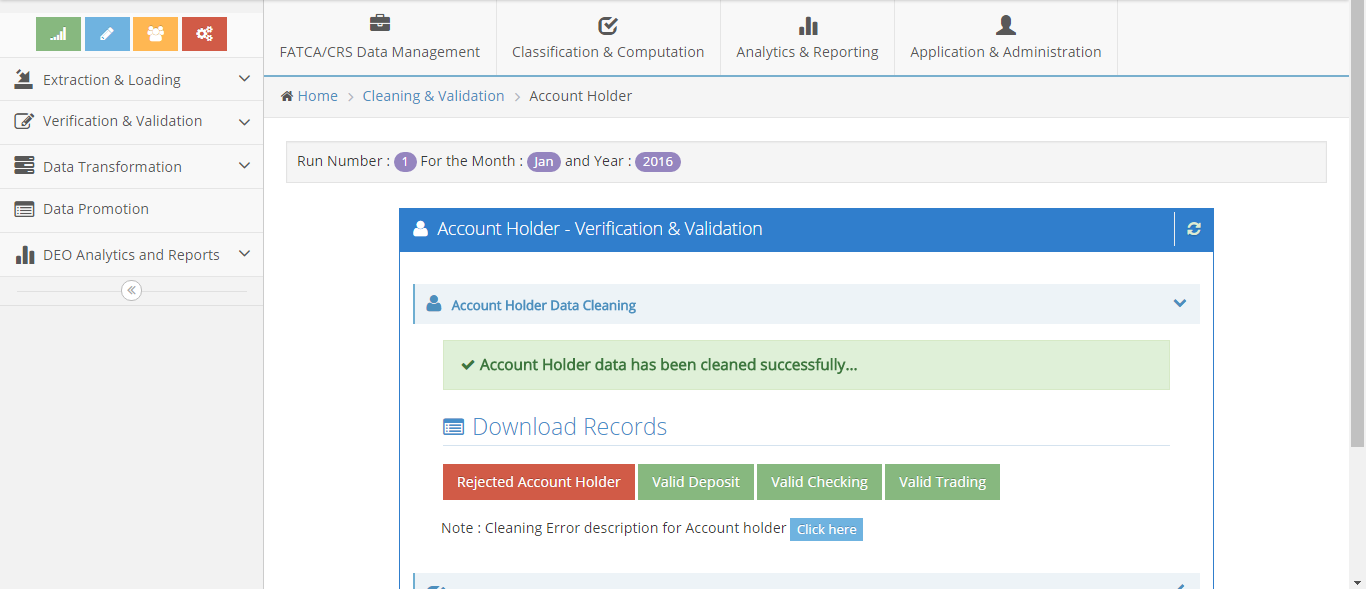

Comprehensive data cleansing for consistent data.

Data cleaning process helps to rectify the missing data, special characters removal, case conversion and conversion of Null’s to Zeros & Zero’s to Null’s of the data. It also involves removing errors and anomalies or replacing observed values with true values from data.

Learn More

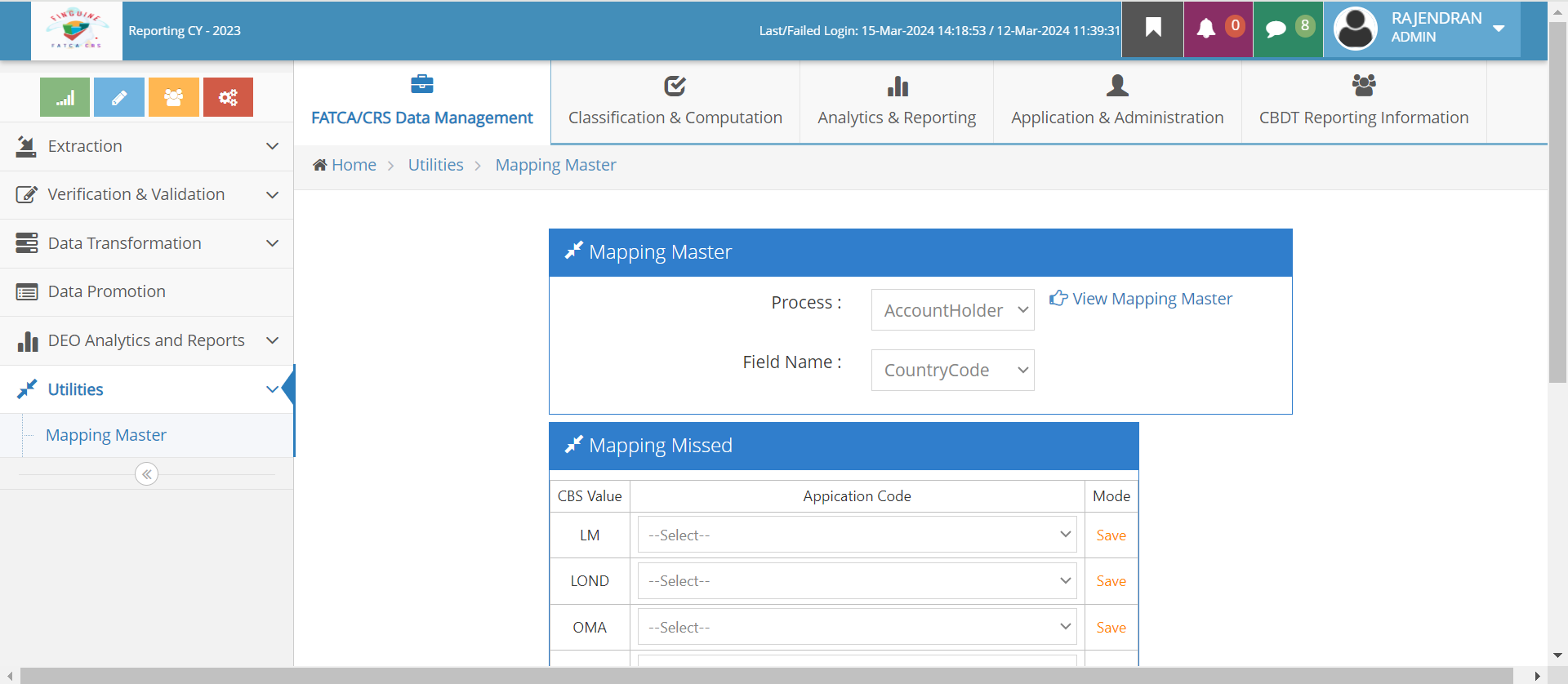

Standardization of customer data as per the FATCA-CRS standard shall make understanding the reportable data easier.

Data mapping provides visibility into end-to-end data lineage that match data fields from multiple datasets into a schema present in our centralized database in order to reduce the potential for errors during reporting by converting data format into a reportable format.

Learn More

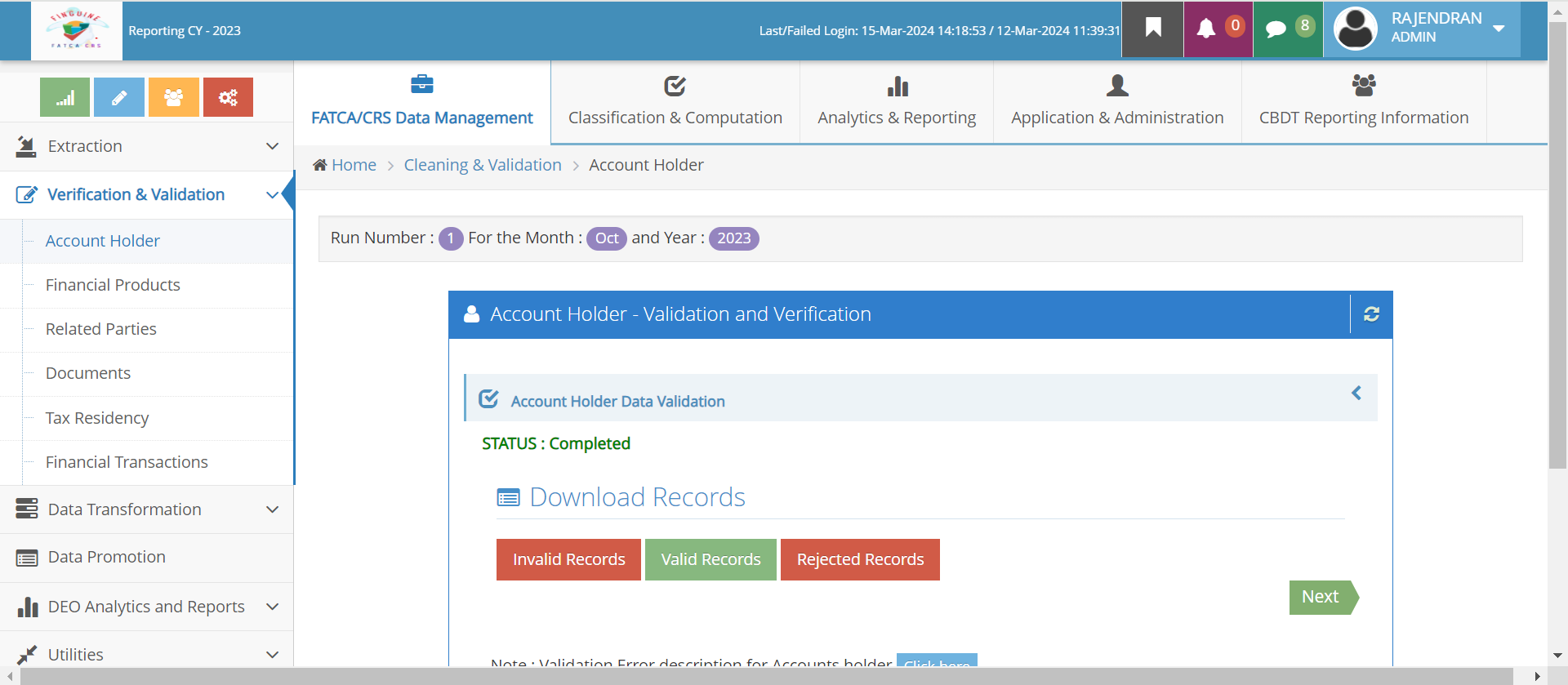

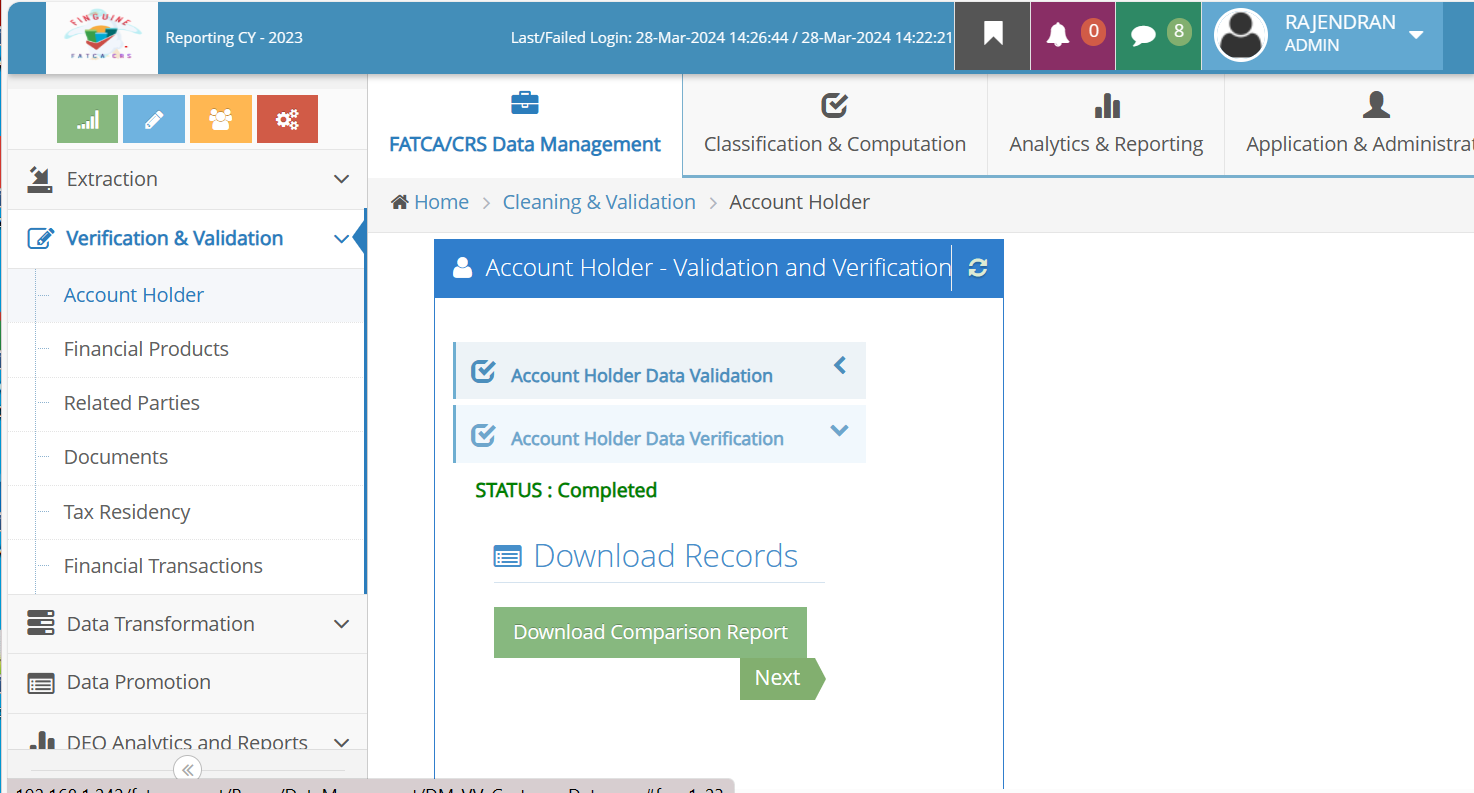

Verification aids in ensuring that the information provided by individuals or entities complies with all applicable laws, rules, and regulations.

Validates the data for correctness of values under each data element and verifies the values of inter related data elements. Following the guidelines stated, will guarantee a more effective and efficient submission process.

Learn More

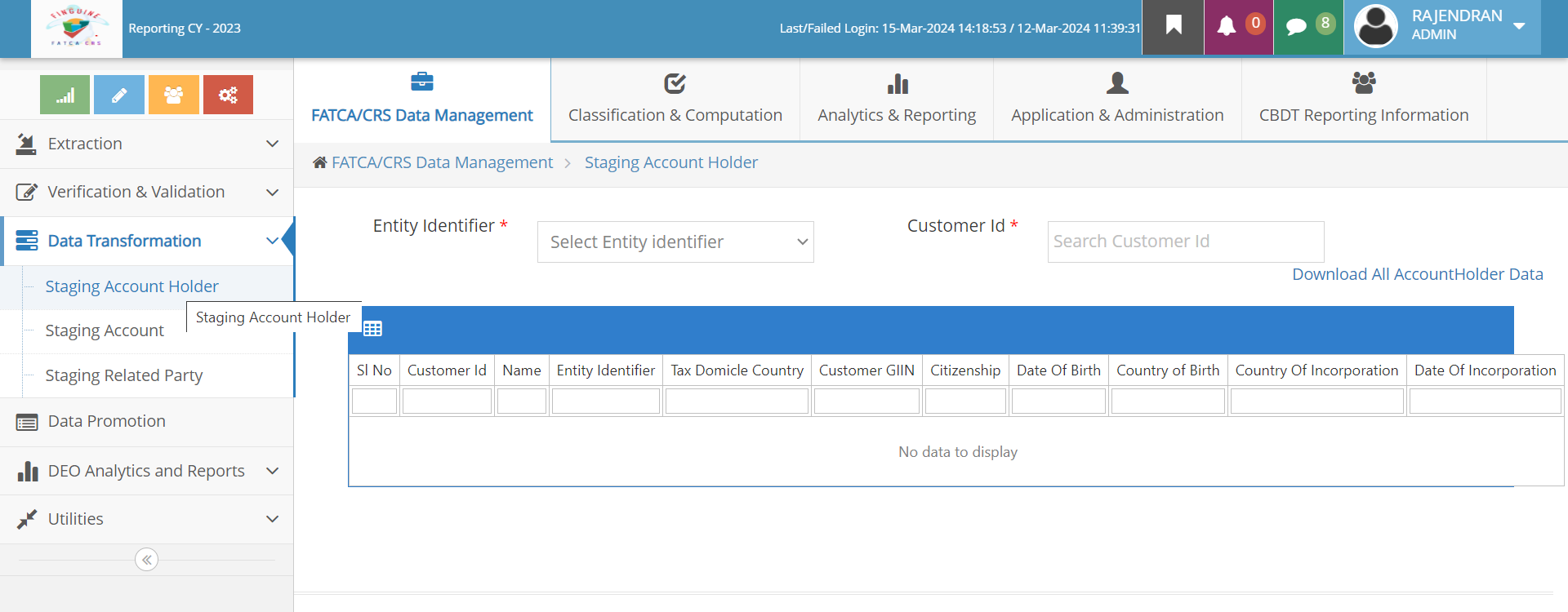

Transforms the data to FATCA & CRS codes as per the requirements for reporting to various statutory authorities. Transfers the data for Analysis and Classification purposes.

Transformation process involves can converting, cleansing, and structuring data into a usable format that can be analyzed for the classification of data as per the statutory standards. Transfers the data for Analysis and Classification purposes.

Learn More

Data completeness validation and generation of associated validation report for each field and account.

Customer data shall be validated based on the formats configured in the application as per the FATCA-CRS standard for address, PAN, SSN, TIN, EIN, GIIN, Phone no etc. And specific validation report is generated for correction by the Administrator and re-uploading. The system poses smart auto correction mechanism when enabled can get applied automatically.

Learn More