61B-Filing

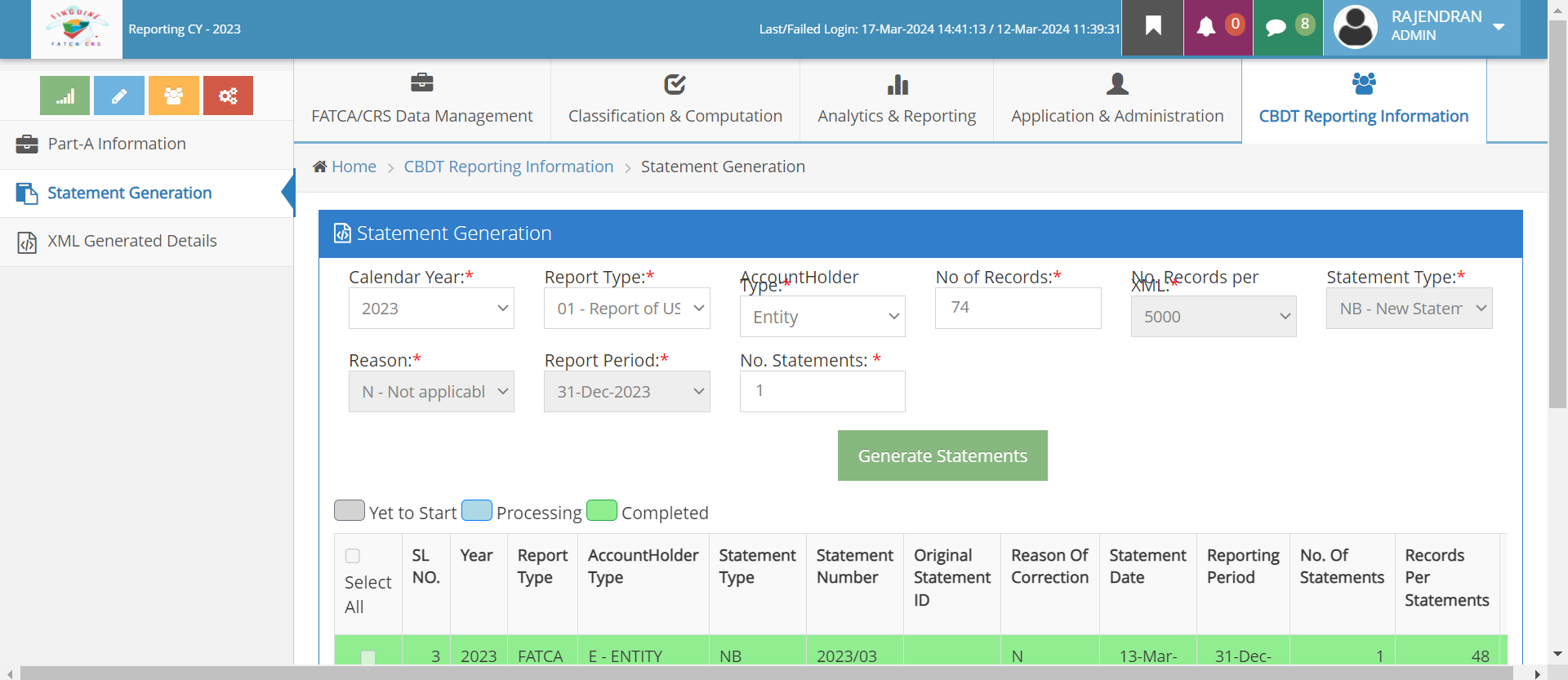

In India, FATCA & CRS compliant data have to be reported to CBDT (Central Code of Direct Taxes) in form no. 61B as per income tax act. This data will be structured in XML and the data will be uploaded by the designated director using DSC(Digital Signing Certificate), Finguine has the capability to validate the data as per 61B XML Schema and to handle CBDT defined errors.. For other jurisdictions, reports will be generated as per the format stipulated by respective countries after making the data error Free.

Schedule a DemoCBDT has provided a utility for schema validation and data validation of mandatory data items.

In order to reduce the time taken by the CBDT validation utility, VSM has developed it’s own utility and integrated the same with Finguine.

Learn More

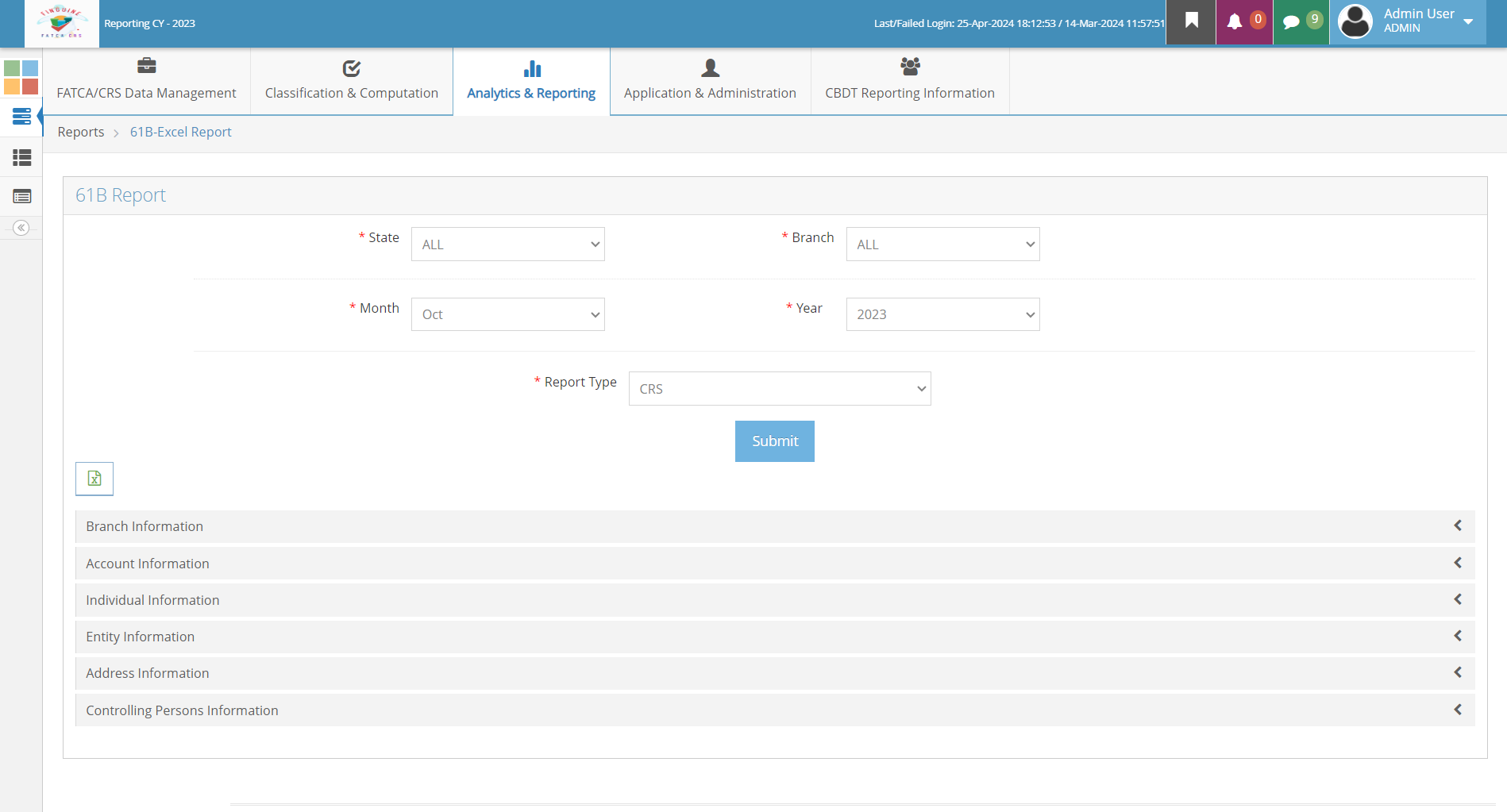

All reports of the application can be downloaded by the users in Excel format or PDF for data remediation purposes.

Context sensitive reports are provided for the users requirement during the data processing cycle. MIS reports are also available for monitoring the progress in data remediation.

Learn More